New Car Loan Interest Rate Malaysia 2018

Average Interest Rate for a new car is around 30 to 40 depending on. How do insurers calculate car insurance premium rates in Malaysia Post de-tariffication.

Toyota Alphard Executive Lounge V6 1 23 Crore Real Life Review

If your account balance goes beyond RM200000 the effective interest rate EIR will begin to decrease.

. The Peoples Bank of China held steady its key rates for corporate and household loans at July fixing as the central bank is trying to support ongoing economic recovery in the wake of COVID-19 outbreaks. Interest Rate Total Interest. Check new car model below RM150000 in Malaysia with price specifications and review.

For instance if you have RM250000 in your account you only earn an EIR of 216 pa. Before July 2017 the premium rates for car insurance in Malaysia were pretty much the same based on the value of your vehicle and its engine capacity across all insurance providers. Or Percentage Symbol.

Two main types of car loans. Use only numbers without Comma or Percentage Symbol. Interest Rate in India averaged 637 percent from 2000 until 2022 reaching an all time high of 1450 percent in August of 2000 and a record low of 4 percent in May of 2020.

Personal finance may involve paying for education financing durable goods such as real estate and cars buying insurance investing and saving for retirement. Generally there are two types of car loans and the interest rate may vary as it depends on the base rate the bank you choose and if you are getting a new car or a used car. Best Car Buyers Guide in Malaysia.

How does a Car Loan work in Malaysia. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. The interest rate and monthly installments stay the same throughout the loan period.

Car Bike Price. Personal finance is defined as the mindful planning of monetary spending and saving while also considering the possibility of future risk. Tiered up to 230 pa.

Instead of the 230 pa. If you saved for years for your brand spanking new car youll definitely want to get comprehensive car insurance. Applicable for account balances between RM100000 to RM200000.

Personal finance may also involve paying for a loan or other debt obligations. Consider TPO if your car is at least 10 years old and fully paid off or if you have a cheap ha cheap second-hand car and its already banged up anyway. Average Interest Rate for a new car is around 30 to 40 depending on Bank Type of Car and Years of Installment.

While the five-year rate a reference for mortgages was maintained at 445. This page provides - India Interest Rate - actual values historical data. The one-year loan prime rate LPR was left unchanged at 37.

If its really badly damaged you might choose to scrap the car. The board last week rolled over a.

Auto Loan Interest Rates Great Savings Concept Image Of Auto Loan Blue Background Interest Rate Savings Stil Blue Backgrounds Coloring Markers Blue Desk

What Is The Average Car Loan Length

Pin By Ana Laura Pommier On Autos Car Advertising Design Digital Advertising Design Car Advertising

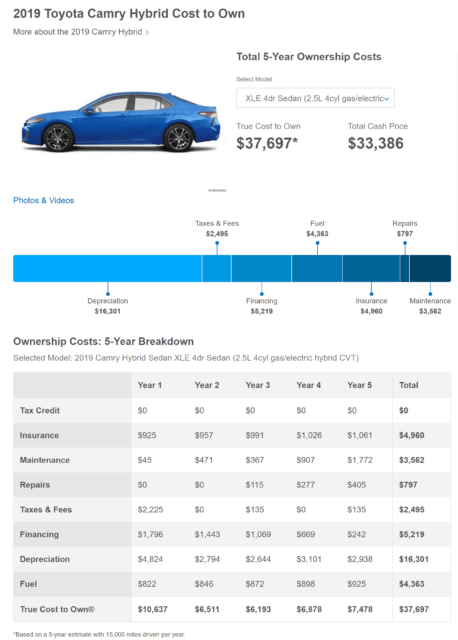

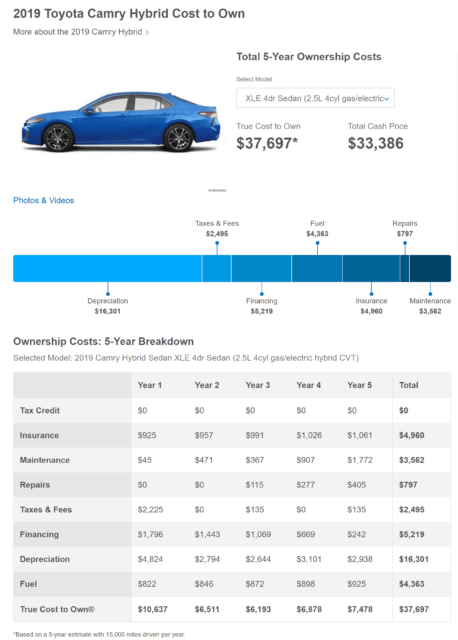

Yes Buying A New Car Makes More Sense Than Buying Used Wealthtender

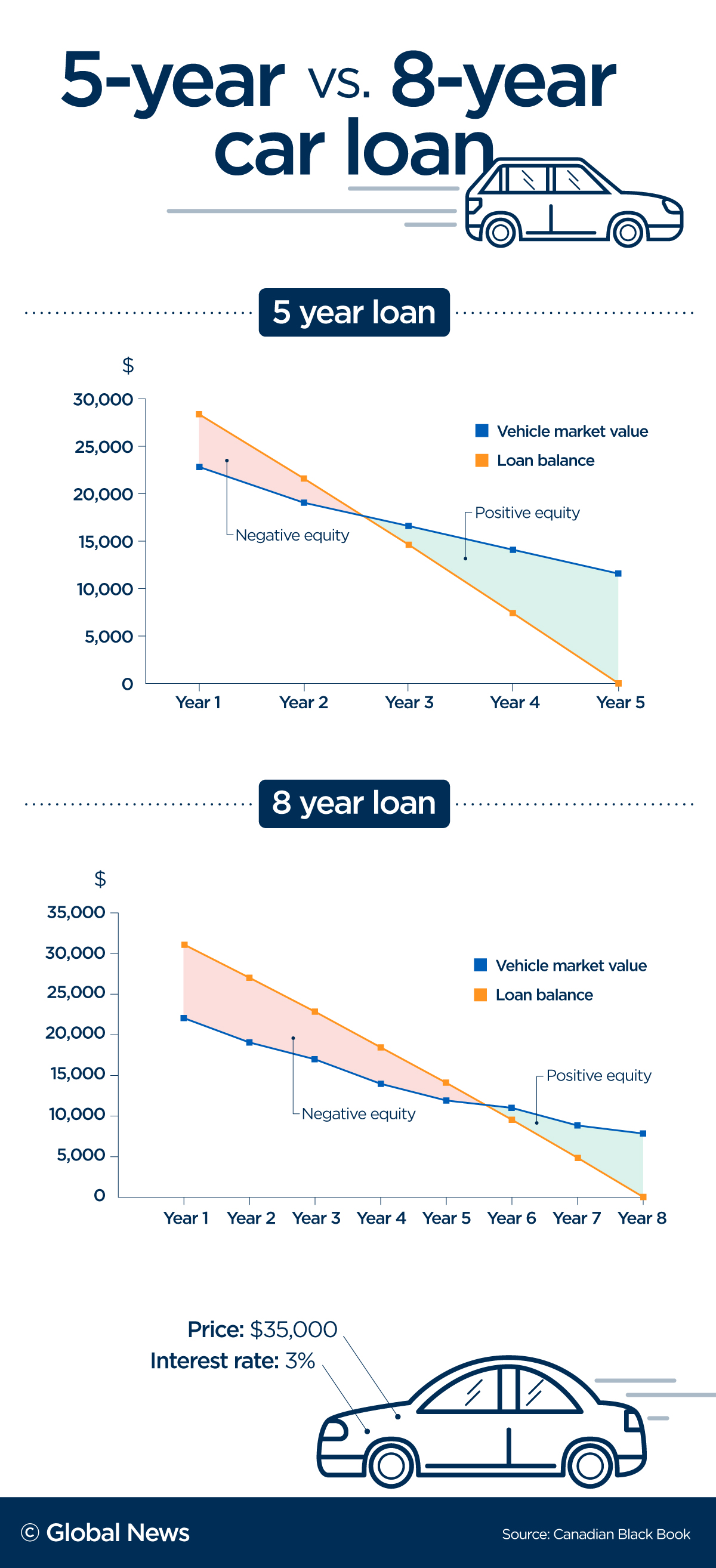

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

Comments

Post a Comment